We are a firm of chartered accountants and tax advisers supporting businesses and individuals with their accounting and tax matters.

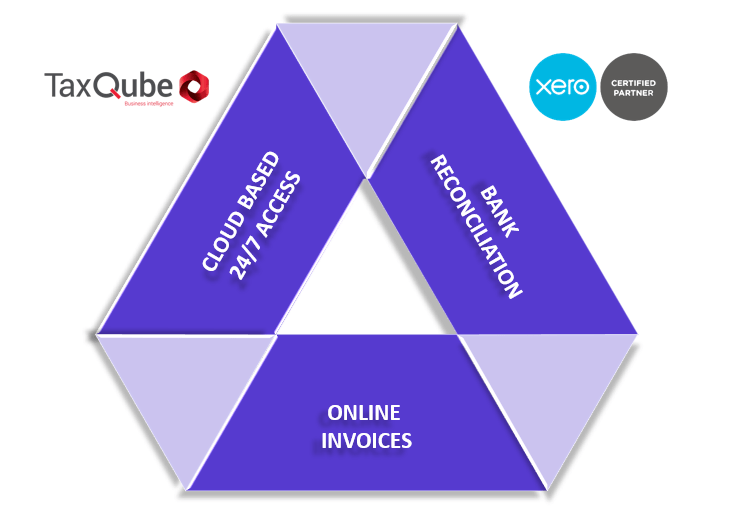

Being specialists in helping the construction industry means that we can quickly identify your requirements and deal with any problems efficiently and effectively. We are able to transform messy books into neatly organised records using cloud accounting software as our tools.

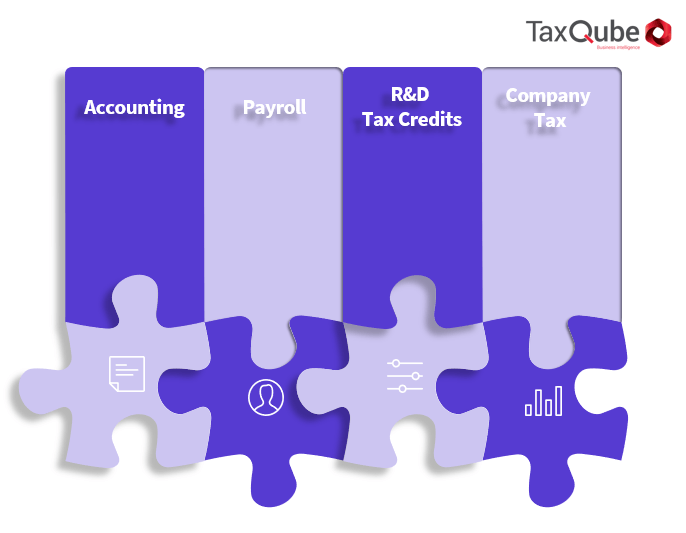

Our payroll process is designed to take the stress out of managing payroll (PAYE) and sub-contractors (CIS). We can help you to stay on top of legislation such as IR-35, reverse charge, MTD and compliance with these obligations on behalf of the company. We have seen returns being poorly prepared which can lead to over payment of tax without realising.

As record keeping is done at the same time as the preparation of VAT returns, tax planning is also difficult if data is not reliable. We offer cost-effective solutions to companies to ensure good compliance with less stress.

Management of different projects can be a daunting task but it is important not to mix everything and have clarity on each project. We are helping many construction industry clients to prepare project reports and apply tools to manage labour and material cost.

R&D tax credits in the construction industry is widely underclaimed and confusing to most business owners. Where applicable, we proactively try to boost cash flow of our clients using R&D tax credits. It is not a loan that needs to be paid back, this is your money to grow the business and hire more staff.

You can hire an outsourced Finance Director to help you grow and manage the business. By appointing an FD for your business, you can set up regular meetings to ask questions and discuss financial matters. We can attend meetings with you and present financial information to attendees. Please contact us for more information.

We help your business to become tax efficient by using tax planning tips and techniques. We often see professionals who are paying too much tax as a result of making mistakes themselves or using non-specialist accountants.

This is our most popular service for busy companies. It enables business owners to keep track of income and expenses in real time. Regular management reports is a powerful tool that delivers a good return on investment by strengthening your decision making skills and enable transparency in the business.

Are you using a tax efficient structure to run your business? How would you deal with claims against your company when something goes wrong? We have seen several construction companies go bankrupt when claims are made against them, we protect your position from such claims and improve tax efficiency.

Chartered Accountants | Experienced Tax Advisers

To find out more, complete the enquiry form or call us on 0208 1234 768

Please provide as much detail as possible. One of our experienced business advisers will contact you to discuss further.