A corporation tax rebate to invest in your business every year. We are specialist advisors to maximise your claim and check eligibility.

Save thousands of pounds in Tax | Professional unbiased advice.

Research and Development Tax Credits are a UK tax incentive scheme created by the UK government to encourage companies to invest in R&D. Our clients can lower their tax bill or claim cash back as a proportion of their R&D expenditure.

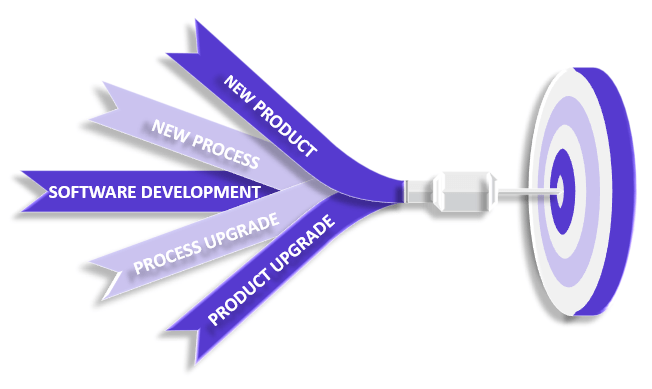

If your company is creating new products, new processes/services or modifying existing products to improve performance there is a good chance that your company qualifies for R&D tax credits. R&D can take place in any sector regardless of the company size. It could be in all types of industries including manufacturing, engineering, construction and software development etc.

TaxQube started its operations to support accountancy firms to deal with various tax jobs including R&D tax credits. TaxQube utilises skilled specialists from a diverse background to provide R&D knowledge. Our core team of technical members have a wealth of knowledge in R&D Tax credits. The majority of our technical members are trained by UK’s leading accountancy firms.

Over the years we have fine tuned our claims process to quickly identify qualifying activities and complete the job within weeks unless there are circumstances outside of our control. Even if you are already claiming, we might be able to improve and simplify the process for you. Book your free consultation with us.

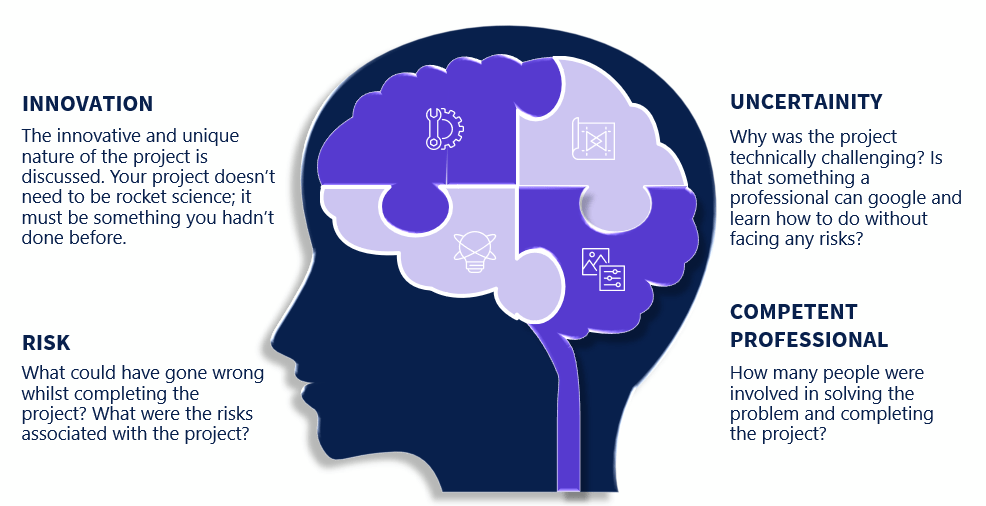

We know that a lot of businesses find R&D tax credits too complicated. It’s not rocket science and certainly not limited to scientists. We’ve helped many companies to understand the rules and how this legislation could be applied to their work.

Let’s start with a simple conversation (1) You have made changes/updates to your product and processes. (2) The changes you have made weren’t too obvious, you weren’t sure about whether or not they were going to work.

Don’t like numbers? No problem. Just introduce us to your accountants and we will request the required information.

Get in touch today for a free consultation.

We understand that every business is different and therefore, requires a bespoke methodology that works for them. We meet/Zoom meetings with the company directors and the technical team (where applicable) to gather information and prepare a brief summary of what we identify as eligible R&D.

Without any upfront fee, at this stage of the process, we also get the letter of engagement signed by the company director to complete the formal appointment.

Now we want to know more about the points we identified during the first stage. We will ask you more questions about the project and check it against the legislation. Don’t worry, we don’t speak the legal language but it is important to make sure that we are satisfied with the project to ensure eligibility to R&D funding.

Do you know that based on our experience, we have an in-depth understanding of various technical industries and we will tell you if we conclude that you don’t qualify for the relief. We look beyond the obvious R&D projects and engage with the technical staff members of your team to help maximise your R&D claim and assess eligibility.

We deal with HMRC on your behalf and answer their questions. Once submitted, we receive the credits from HMRC in three to six weeks on behalf of your limited company. We pay funds into your company’s bank account on the same day.

If your company is profitable, your overall Corporation Tax bill will be reduced, or if you had already paid your bill for the period, you will receive a repayment in cash. If your company had made a loss for the period, a cash benefit can be obtained.

Every industry is different and to get the best value, it is important to work with someone who knows your industry. We understand and deal with a range of industries that enables us to quickly understand your requirements and deliver solutions. Have a look at our industry specialism from the main menu.

We use tools such as Xero and Quickbooks to automate process. Contact us for a free account review. We manage cloud accounting systems on behalf of a number of companies and help them to extract the best value from these systems.

To boost cash flow for our clients, we prepare high-quality R&D technical reports to support every claim submitted by us. We also provide professional representation from start to finish to deal with HMRC on your behalf.

Research and Development Tax Credits are a UK tax incentive scheme created by the UK government to encourage companies to invest in R&D. Companies can lower their tax bill or claim cash back as a proportion of their R&D expenditure.

Most eligible companies think that they don’t qualify for tax credits as the word “R&D” is generally associated with people in white coats. However, in reality, the rules are much more relaxed and we have seen qualifying problem solving in almost every industry.

1. Be a limited company in the UK that is subject to Corporation Tax.

2. Have carried out qualifying research and development activities.

3. Have spent money on these projects.

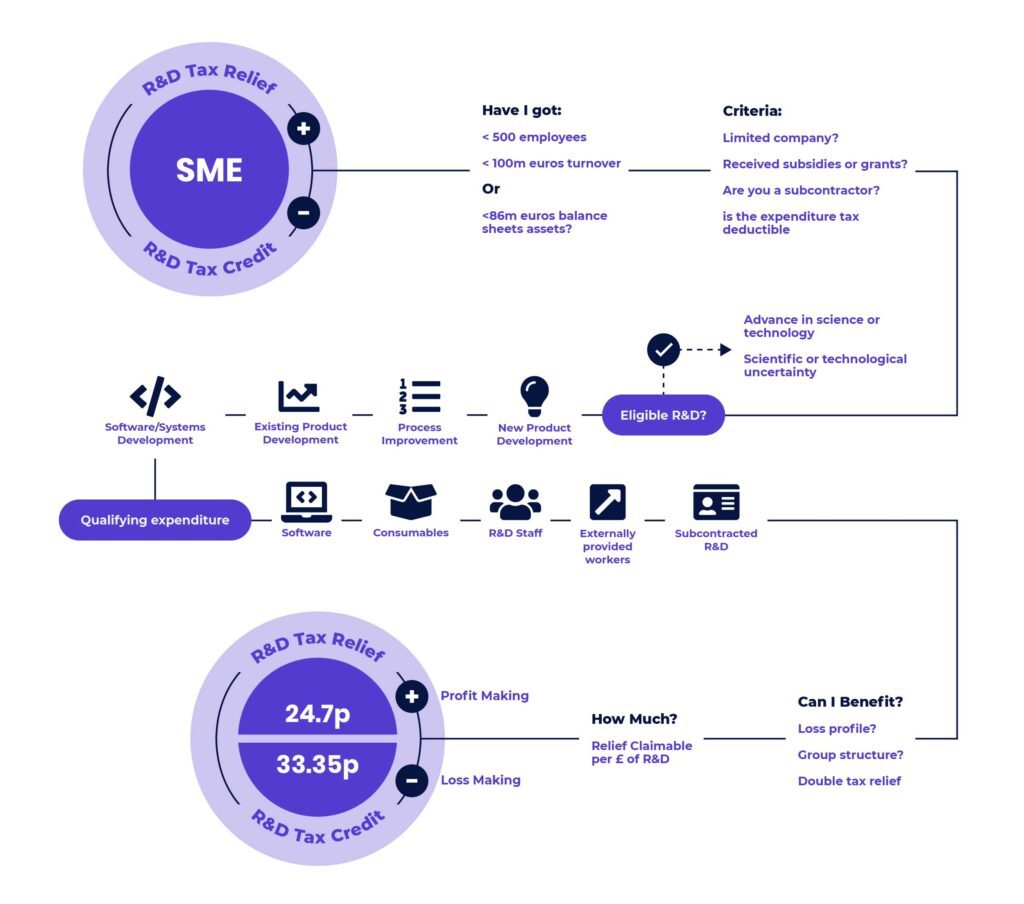

Companies that spend money developing new products, processes or services; or enhancing existing ones, are eligible for R&D tax relief. If you’re spending money on your innovation, you can make an R&D tax credit claim to receive either a cash payment and/or Corporation Tax reduction. The expertise of an R&D professional is in the ability to identify qualifying activities by talking to you. R&D exists in every single sector, however it does need technically skilled people to identify and maximise your claim. And if you’re making a claim for the first time, you can typically claim R&D tax relief for your last two completed accounting periods.

Depending on your company’s profitability the credit is paid as follows: Profit making company: For every £1 spent on qualifying expenses, HMRC give a credit of 24.7p Loss making company: For every £1 spent on qualifying expenses, HMRC give a credit of 33.3pIn other words, if something is costing you £100, you can get back either 25% or 33% of that expense back from HMRC. Therefore, after HMRC’s credit you are effectively paying less in expenses. You can use our R&D tax credits calculator below to get an estimate of how much you can get back from HMRC.

Dealing with subcontracting is a complex area. However, you can still make an R&D tax claim. You can claim 65% of the payments made to the subcontractor unless you’re part of the same group. We also consider the following factors:

If you are unsure about whether your sub-contractor cost qualifies for the relief, you can contact us and we’ll be happy to check this for you.

No, only UK registered limited companies can claim. If you think you are likely to be eligible in the future, we recommend switching to a limited company to protect your future eligibility position. Past eligible activities are unfortunately non-claimable.

You can still claim however, it is possible that you are required to claim under the RDEC scheme (Research and Development Expenditure Credits) which is otherwise known as the large company R&D scheme.

Yes, you can. Please complete the contact form on the website and ask for our introducers’ agreement.

Yes, you go back up to two accounting periods. Any eligible projects prior to that period are non-claimable.

Absolutely, R&D tax credits are payable regardless of whether a project is successful or not. It is a common misunderstanding that R&D is only payable on successful projects.

Yes, projects that stretch over a number of accounting periods can be claimed in all of those accounting periods as long as the risk is still associated with the project. We mark projects as “ongoing” in our reports to HMRC until they are finished or the risk disappears.

Yes, you can claim R&D tax credits on overseas projects. The location of the project is not a factor considered to establish eligibility to R&D tax credits. It is important to understand the company must be subject to UK corporation tax. Overseas expenses linked to R&D eligible project are included in the claim.

The following expenses are not eligible for R&D tax credits:

The claim is submitted to HMRC along with the company’s corporation tax return. If you have already submitted the return, we can amend it to include the R&D claim. We have simplified the R&D process for our clients. We always prefer to meet where possible and put you through a refined process to identify and claim R&D tax credits.

Experienced Tax Advisers | Monthly Fixed Fee | Chartered Accountants

To find out more, complete the enquiry form or call us on 0208 1234 768

Please provide as much detail as possible. One of our experienced business advisers will contact you to discuss further.