We are a partner-led firm of chartered certified accountants and tax advisers supporting companies and individuals in the UK.

We are focused on working collaboratively with businesses and personal tax clients, to understand their overall financial position and, advise them of suitable tax optimisation strategies. Trusted by high growth companies and high earner tax payers, our packages are designed to enable supportive business relationships. Our professional advisers are skilled at helping companies to grow and to take full advantage of tax reliefs.

We offer tailored advice that is suitable for your business and in line with HMRC. We get to know our clients and use this information to offer a suitable tax efficient structure that includes remuneration planning and salary/dividends planning etc.

We often see companies missing out on eligible tax reliefs that can sometimes be specific to your industry. For example SEIS, R&D Tax Credits or contaminated land relief. We actively engage with our clients to free up their time by using modern methodology and systems.

Businesses supported by professional business advisers perform a lot better and grow quicker. We have made changes to our clients’ businesses that saved them thousands of pounds every year, not a bad return on investment (ROI).

We are well known for our understanding of tax planning and have helped companies and individuals to save tax. We highly value client relationships and regularly communicate with them to gain a better understanding of their financial affairs.

We maintain a good working relationship with HMRC and regulatory bodies to ensure transparency and compliance with the legal system. We equally value our client relationships based on mutual respect and trust. Our advice is to proactively utilise various tax incentives designed and encouraged by the government.

TaxQube rewards innovation by helping UK Limited companies claim government’s funding and grants. In addition to that we offer experienced tax advisers and commercial accountants to achieve the most tax efficient solution for your business.

Our typical clients are ambitious companies that need expert support to ensure compliance and business growth. We also work alongside other professional firms to manage client portfolios and add value.

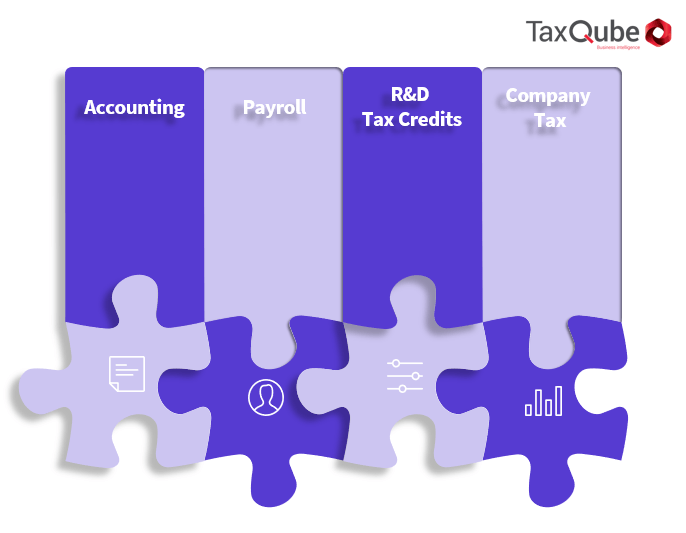

If you wish to start a new business or take a step back from dealing with accounting tasks, let our expert team handle these for you. Annual accounts, VAT, Xero bank reconciliation, audit of key accounts and management reports can provide you with better control over your business. If you wish to be added to our portfolio, contact us today to discuss our pricing.

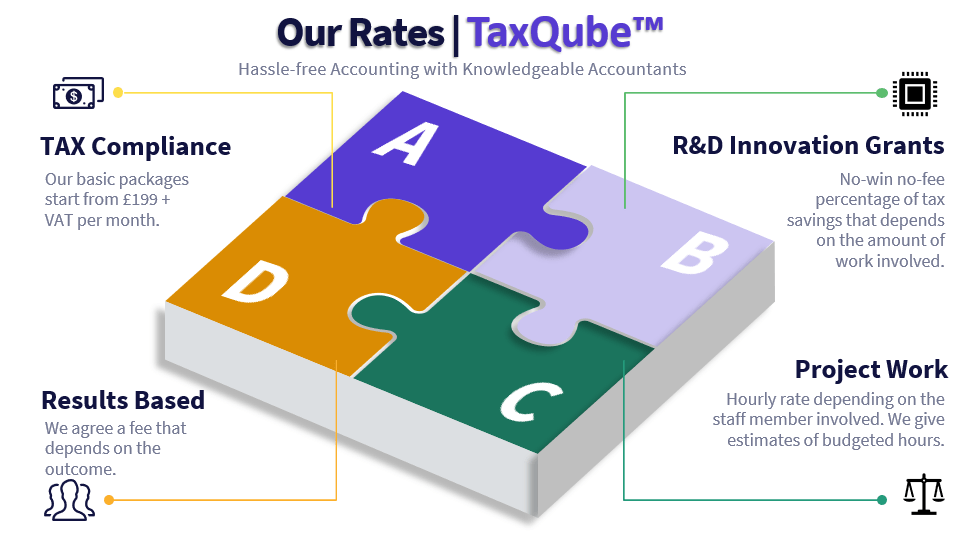

We know that a lot of businesses find R&D tax credits too complicated resulting in under claiming the cost or poor narratives, it is not rocket science and certainly not limited to scientists. We act as an outsourced R&D team for UK companies and help them identify and claim R&D tax credits to boost cash flow on a no-win no-fee basis. Contact us to arrange a consultation.

We fully understand how important it is to benefit from good processes in business. Therefore, we stay in contact with you to understand your business and introduce you to industry’s best practices. We recommend reviewing and upgrading your systems if your company’s turnover is more than £500,000 a year. At this stage, the benefits will be greater than the cost and you can avoid a potential burnout. Don’t worry if you are already in a messy position, we can help you out.

We use the best tools the right way to look after our client portfolio businesses. You are hard pushed to find a technology for your business that beats the current Cloud based ecosystem. We work with several systems that include Xero, Quickbooks, Sage, FreeAgent and various other industry solutions. Contact us to get a discount on your monthly subscriptions. You don’t even need to be our client to get a discount from us, it is a lot cheaper than buying direct.

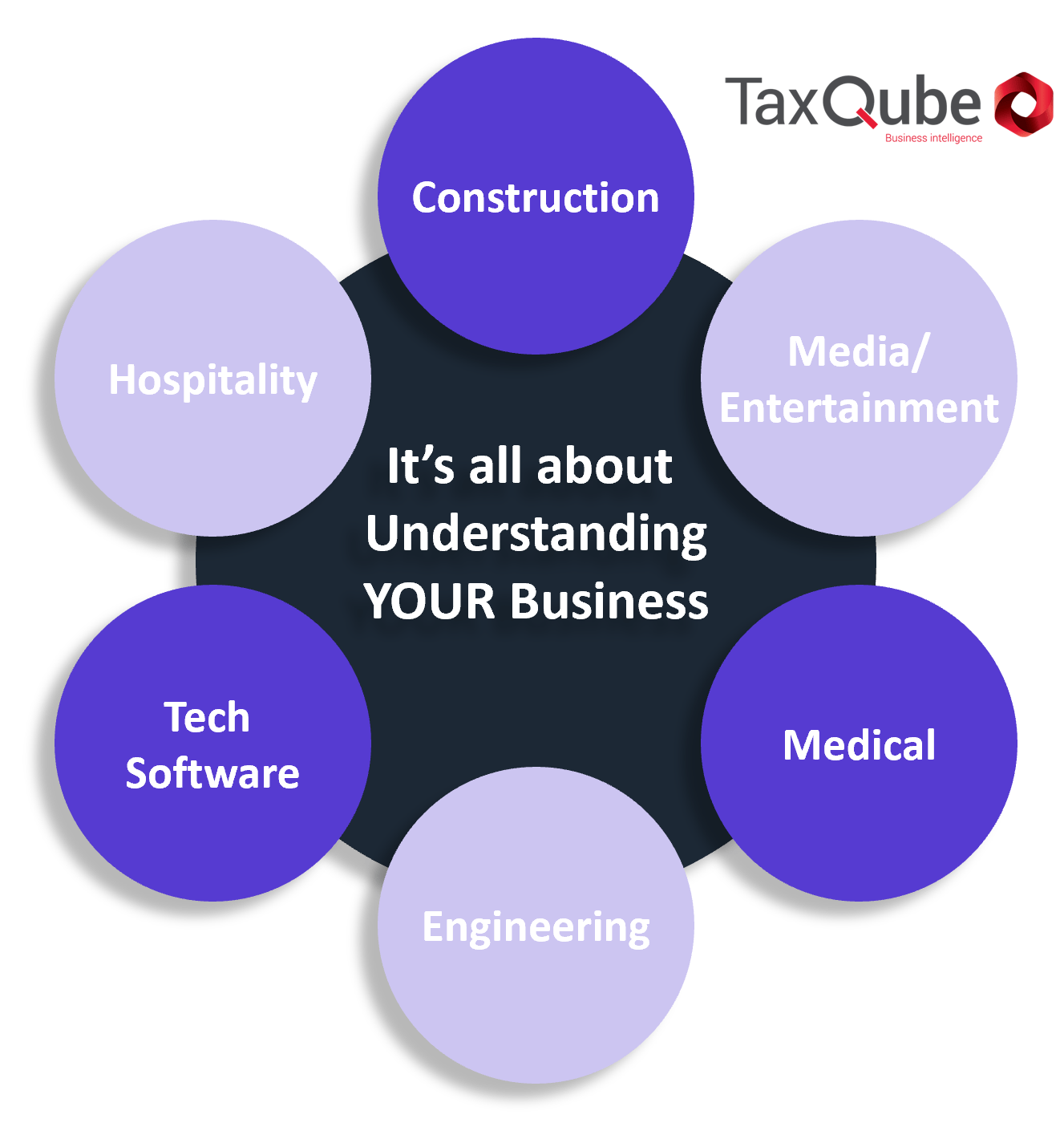

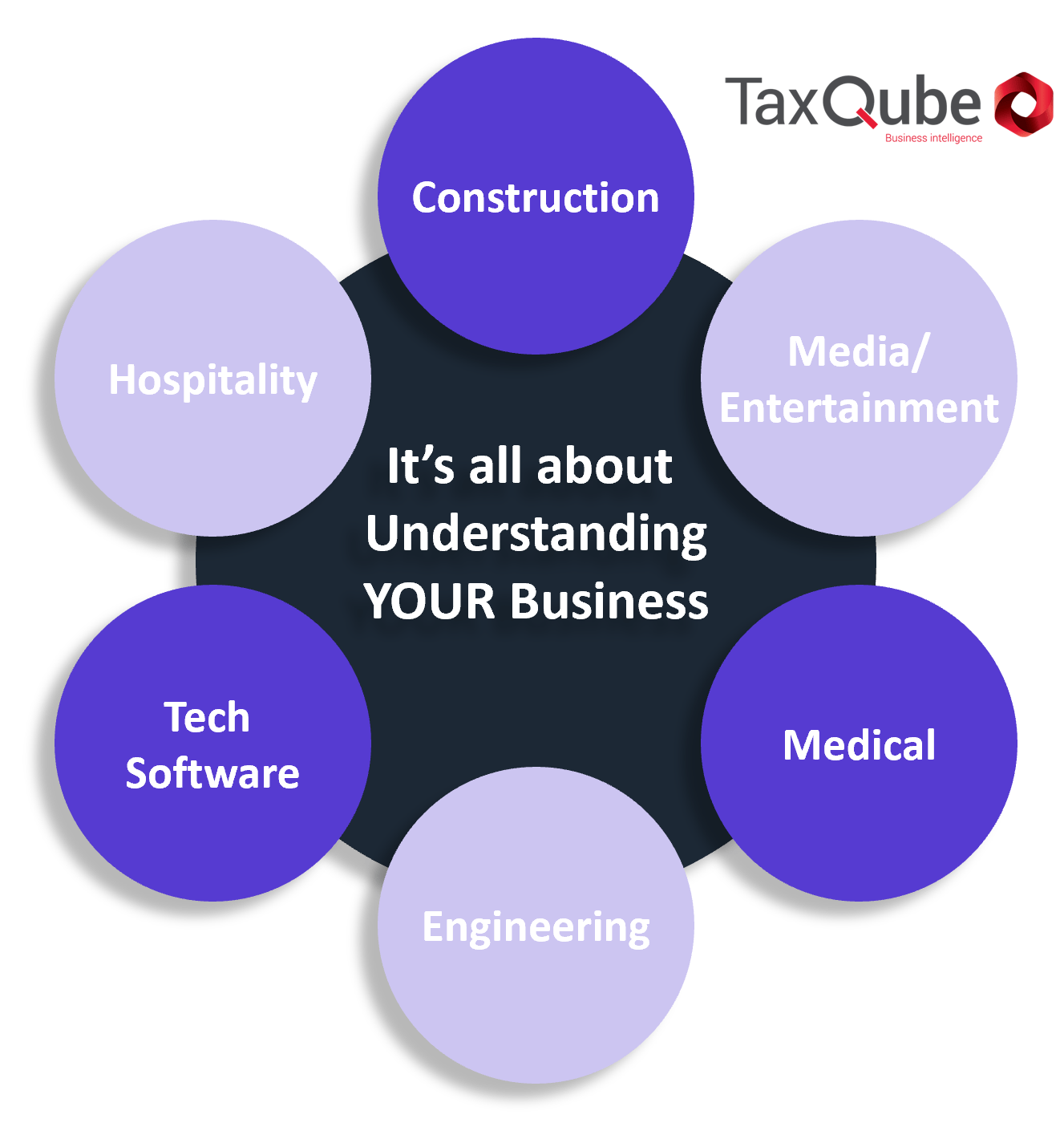

Every industry is different and to get the best value, you need to work with someone who knows your industry. We understand and deal with a range of industries that enable us to quickly understand your requirements and deliver solutions.

We use cloud based tools to automate processes that cuts a lot of admin. Contact us for a free business review with our advisers. We manage cloud accounting systems on behalf of a number of companies and help them to implement these systems properly.

Unfortunately, a lot of companies miss out on tax incentives. We perform high quality business reviews which are capable of pointing out opportunities within businesses. Contact us today for a free review. It’s one hour consultation with our business advisors to help you and your business.

Qualified Accountants | Experienced Tax Advisers

To find out more, complete the enquiry form or call us on 0208 1234 768

Please provide as much detail as possible. One of our experienced business advisers will contact you to discuss further.